| DAE Capital | DAE Group | Engineering

Total Revenue increases 16% to US$1.3 billion; Profit for the Year of US$351 million

Dubai, U.A.E., 7 February 2024 – Dubai Aerospace Enterprise (DAE) Ltd today reported its financial results for the year ended December 31, 2023. The consolidated financial statements can be found here.

Selected Financial Highlights:

| Year Ended

|

||

| US$ millions

|

Dec 31, 2023 |

Dec 31, 2022 |

| Total Revenue | 1,315.7 | 1,137.8 |

| Profit/(loss) for the year | 350.6 | (279.3) |

| Operating Cash Flow | 1,233.2 | 1,281.8 |

| Adjusted Pre-Tax Profit Margin (1) | 18.8% | 21.1% |

| Adjusted Pre-Tax Return on Equity (1) | 8.5% | 8.2% |

| As at

|

||

| US$ millions

|

Dec 31, 2023 |

Dec 31, 2022 |

| Total Assets | 12,262.5 | 12,709.1 |

| Net Loans and Borrowings | 7,592.1 | 8,045.9 |

| Available Liquidity | 4,062.2 | 2,659.9 |

| Net-Debt-to-Equity | 2.53x | 2.64x |

| Unsecured Debt Percentage | 73.3% | 69.8% |

| Liquidity Coverage Ratio | 290.0% | 341.0% |

1. 2022 results are adjusted to exclude a net exceptional write-off of US$576.5 million related to the loss of control of 19 aircraft that were previously leased to airlines based in Russia. 2023 results are adjusted to exclude cash settlement proceeds of US$118.3 million.

Selected Business & Operational Highlights:

- Number of aircraft acquired: 20 (owned: 10; managed: 10)

- Number of aircraft sold: 30 (owned: 22; managed: 8) (2)

- Acquired a 64 aircraft order book position

- Lease agreements, extensions, and amendments signed: 150 (owned: 114; managed: 36)

- Owned portfolio contracted: 99.7%

- Number of man hours booked: ~1,500,000

- Number of checks performed: 316

- Appointed as the Middle East’s first Boeing 737-800BCF conversion line in partnership with Boeing

- Announced the expansion of Joramco’s facilities in Amman, Jordan, which is expected to reach 22 maintenance lines in the second half of 2024

- Morningstar Sustainalytics ESG Risk Rating: 12.5; Industry Top-Rated and Regional Top-Rated for third year running; Lowest ESG Risk Rating of any rated aircraft lessor

2. 2022 results are adjusted to exclude a net exceptional write-off of US$576.5 million related to the loss of control of 19 aircraft that were previously leased to airlines based in Russia. 2023 results are adjusted to exclude cash settlement proceeds of US$118.3 million.

Commenting on the results, Firoz Tarapore, Chief Executive Officer of DAE, stated, “

Our Full Year 2023 financial results demonstrates the continued strength of our expanding franchise as we acquired 20 aircraft and a 64 aircraft orderbook with near-term delivery positions.

Our Engineering division posted record results with sizeable increases in output and revenue. We are continuing to invest in the facility, having broken ground during the year on additional hangar capacity and announcing a partnership with Boeing to become the first facility in the Middle East to be authorized to complete Boeing 737-800BCF conversions.”

Webcast and Conference Call

In connection with the announcement of DAE’s results for the year ended December 31, 2023, management will host a conference call on Wednesday, February 07, 2024 at 09:00 EST / 14:00 GMT / 18:00 GST / 22:00 SGT.

The call can be accessed live by clicking here from your laptop, tablet, or mobile device, or by dialing one of the global dial-in numbers and quoting ‘Dubai Aerospace Enterprise’ when prompted.

Full details of the call can also be accessed live via the link on DAE’s website: www.dubaiaerospace.com/investors.

Forward Looking Statements

Certain information contained in this Press Release may constitute “forward-looking statements” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “could”, “continue”, “expect”, “anticipate”, “predict”, “project”, “plan”, “estimate”, “budget”, “assume”, “potential”, “future”, “intend” or “believe” or the negatives thereof or other comparable terminology. These statements reflect DAE’s current expectations and assumptions and involve known and unknown risks regarding future events, results or outcomes and are not guarantees of future results or financial condition. Actual results, performance, achievements, or conditions may differ materially from those in the forward‐looking statements and assumptions as a result of a number of factors, many of which are beyond DAE’s control.

Non-IFRS Financial Information

This Press Release may include certain non-IFRS financial information, such as Adjusted EBITDA, not prepared in accordance with IFRS. Because of the limitations of Adjusted EBITDA, it should not be considered as a substitute for financial information prepared or determined in accordance with IFRS, as applicable. Where applicable, DAE compensates for these limitations by relying primarily on its IFRS results and using Adjusted EBITDA only for supplemental purposes.

* ENDS *

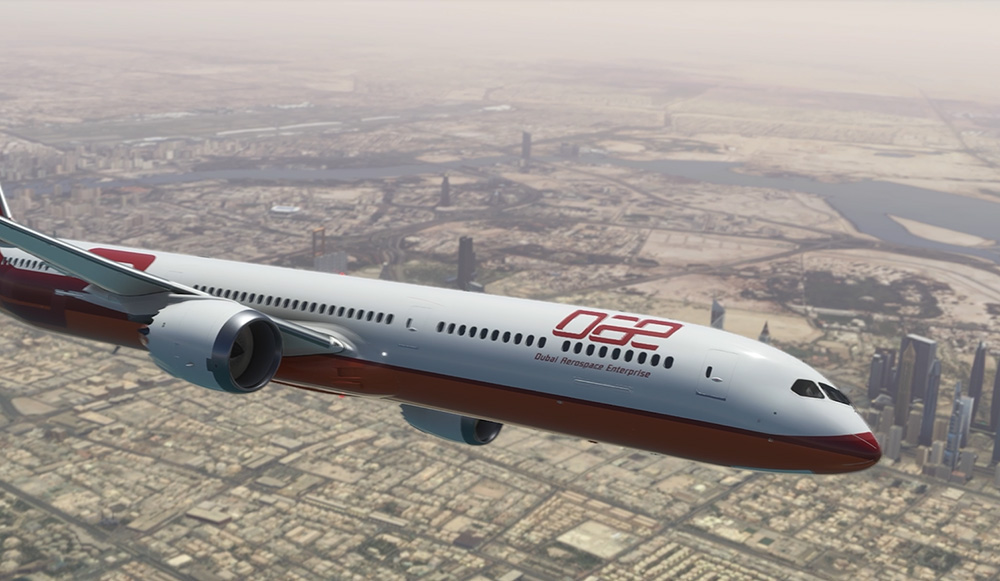

About DAE

Dubai Aerospace Enterprise (DAE) Ltd is a globally recognized aviation services corporation with two divisions: DAE Capital and DAE Engineering. Headquartered in Dubai, DAE serves over 170 airline customers in over 65 countries from its seven office locations in Dubai, Dublin, Amman, Singapore, Miami, New York, and Seattle.

DAE Capital is an award-winning aircraft lessor with an owned, managed, committed, and mandated to manage fleet of approximately 550 Airbus, ATR and Boeing aircraft with a fleet value exceeding US$20 billion. DAE Engineering provides regional MRO services to customers in Europe, Middle East, Africa, and South Asia from its state-of-the-art facility in Amman, Jordan, accommodating up to 17 wide and narrow body aircraft. It is authorized to work on 15 aircraft types and has regulatory approval from over 25 regulators globally. More information can be found on the company’s web site at www.dubaiaerospace.com.

For further information, please contact:

| Media | Fixed Income Investors |

| Deion McCarthy | Deion McCarthy |

| +971 4 428 9576 | +971 4 428 9576 |

| press.office@dubaiaerospace.com | investorrelations@dubaiaerospace.com |