| DAE Capital | DAE Group

Dubai, U.A.E., 14 September 2021 – Dubai Aerospace Enterprise (DAE) Ltd today announced that it had delivered a notice of early redemption (the “Redemption Notice”) to the holders of the Company’s US$500 million of 5.25% Senior Notes due 2021 (the “Notes”). The Notes are scheduled to be redeemed on October 15, 2021. The outstanding principal amount of the Notes as of the date of the Redemption Notice was approximately US$488 million.

The Notes will be redeemed in accordance with the terms and conditions of the applicable indenture at a redemption price equal to 100.000% of the principal amount of the Notes, plus accrued and unpaid interest, if any.

Wells Fargo Bank, N.A. is the trustee and paying agent for the Notes. The terms of the redemption are further described in the Redemption Notice.

In the last 12 months, DAE issued new Senior Unsecured Notes with a combined principal amount of US$3.3 billion with a weighted average maturity of 4.7 years, and redeemed or announced for redemption Senior Unsecured Notes with a combined outstanding principal balance of approximately US$2.2 billion.

This press release shall not constitute a notice of redemption nor does it constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful.

* ENDS *

About DAE

Dubai Aerospace Enterprise (DAE) Ltd. is a global aviation services company headquartered in Dubai. DAE serves over 170 airline customers in over 65 countries from its seven office locations in Dubai, Dublin, Amman, Singapore, Miami, New York and Seattle.

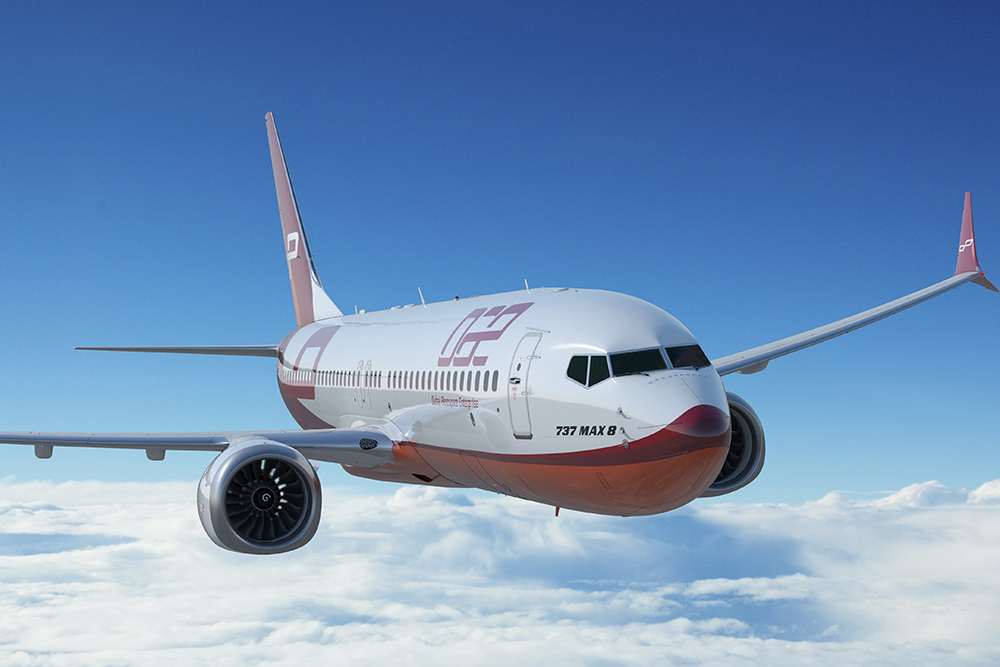

DAE’s award-winning Aircraft Leasing division has an owned, managed, committed and mandated to manage fleet of approximately 425 Airbus, ATR and Boeing aircraft with a fleet value exceeding US$16 billion. DAE’s Engineering division serves customers in Europe, Middle East, Africa and South Asia from its state-of-the-art facility accommodating up to 15 wide and narrow body aircraft. It is authorized to work on 13 aircraft types and has regulatory approval from over 25 regulators globally. More information can be found on the company’s web site at www.dubaiaerospace.com.

For further information, please contact:

| Media | Fixed Income Investors |

| Arne Bevaart | Deion McCarthy |

| +971 4 428 9591 | +971 4 428 9576 |

| press.office@dubaiaerospace.com | investorrelations@dubaiaerospace.com |